Nov

2019

YNAB got us out of debt in 9 months

Have you ever had such an awesome adulting moment when something finally “clicked,” you figured it out, and you just want to SHOUT it from the rooftops?!? I SOLVED OUR BUDGET CRISIS! I GOT US OUT OF CREDIT CARD DEBT FOREVER!!!!! There, I did it!!

As a teacher, I just can’t keep it inside and I HAVE TO tell and help others. I get no kickback from YNAB for this, but I kinda sorta really just want everyone I know/love to use this and make their lives as seamless and awesome as I did for our family. Cuz I love you. And it’s easy. And it works.

A year ago, our family was in major credit card debt and crisis. We had two kids in daycare (HOLY MOLEY! It was more than our mortgage!!!) and a maxed out credit card. I was PANICKING. I mean, one small “oopsie” and we’d have no options – what if our fridge broke? Car accident? Medical trauma? We had no wiggle room on the credit card, and no way to dig ourselves out.

I’m a very frugal person with will power and determination, so I was convinced I could figure this out. My husband suggested we try YNAB, since he had several friends who highly recommended it, and I initially scoffed. $83 a year just to do what I’m already doing with my spreadsheets? Pshaw. How does spending more money help me solve our need for money?? I balked.

Then, I decided to give the 33-day free trial a whirl. Maybe I could learn something new and just cancel my subscription, no money lost. So I signed up, linked our bank accounts, and started “budgeting” on the website. You guessed it – I wound up loving it and staying on for the entire year.

The initial set-up is a huge learning curve. It took about 3 months before I felt like “yeah, I’ve fully got this. I’m ready to teach and help others.” It got pretty frustrating at times, but I persisted. There was a lot of trial and error, asking questions, and waiting to see how things netted out. But I stuck through it, and it was well worth it.

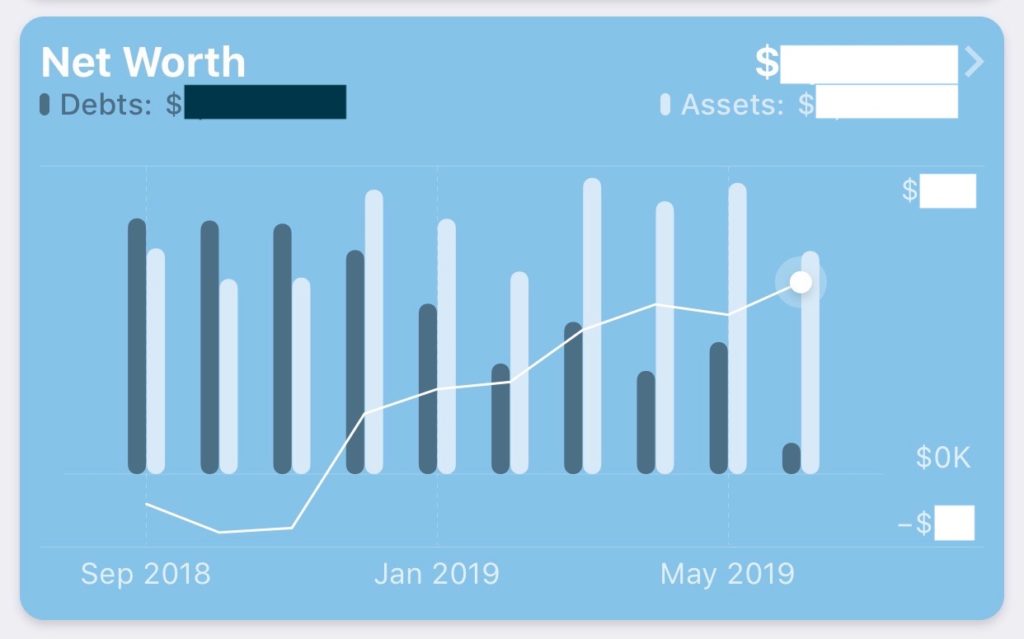

Within 9 months of starting YNAB, we were completely credit card debt free and saving for the future.

How? How can one budget app make all that happen? How did it actually save us money? That’s what I’m going to break down for you…..

MAPPING IT ALL OUT – GETTING A LAY OF THE LAND

The very first thing I did was to dig into our bank statements over the past year. At this point, I am being purely descriptive and just NOTICING our trends, not judging or altering them in any way.

Notebook/pencil in hand, I made a list of the major categories in which our spending occurs. YNAB gives you sample categories, but obviously personalization is key here. I noted the following categories for our family:

- Debt Payments (mortgage, student loans, car loans, home equity line)

- Insurances (life insurance, home / auto)

- Monthly expenses (daycare, utilities, subscriptions like Netflix)

- Variable expenses (groceries, gas, sundries, services like haircuts and dog grooming, medical/dental, vet, home repairs)

- Quality of life (dining out, family activities, gifts, clothing, date night, fun)

I also made a list of big time expenses that seem to happen once a year. I put these into a final category called “Budgeting Ahead” Examples: Tax accountant, Amazon prime annual, Costco membership, Furnace tune-up, Glasses/contacts, Birthday parties, Christmas, etc. These aren’t necessarily things I have to pay for or that are due every month, but like death and taxes, they can’t be avoided when it’s time. The goal would be to start socking away money into these categories so that when the day comes, the money is there for it. At first we had no money to actually put into any of these categories, but I made them just the same so that we would be prepared.

RENEGOTIATING – MAKING ADJUSTMENTS

Once I had all our categories set, it was time to take inventory and make some decisions. Once our first round of paychecks hit the app, I gave “every dollar a job” and assigned them to the categories that HAVE to be attended to – debt payments, insurances, and monthly expenses. Suddenly, with all dollars assigned, I could see just how little we had left for those “Variable” and “Quality of Life” categories. Not much! Time to go on a serious Budget Diet and reign in lots of things. Either a) we can’t spend as much money on day-to-day things we enjoy or b) we need to adjust our obligations so we have more money to spend on variables. Honestly, I chose both!

- First and foremost, we cut WAY back on discretionary spending. We didn’t eat out for at least 4 months while we got our feet back under us. We started bulk shopping/cooking/meal prepping and packing lunches.

- To stop any accidental late payments, we switched completely to auto-pay and online billing. This took a big chunk of time and lots of phone calls, but was well worth it.

- We switched some payments to monthly billing instead of annual to help mitigate large annual lump sums.

- We switched to shopping at Aldi and saved at least $200/month on our groceries.

- We began ordering groceries online and picking up in store to make sure we stuck to my list – no impulse buying!

- We became strong meal planners, and we only did a full grocery shop 3 weeks a month. The 4th week was for baby’s milk only, and we had to live off the leftovers/pantry/fridge for the remainder.

- We researched best prices for diapers, wipes, and formula and signed up for Amazon auto-delivery for those items.

- We cancelled cable.

- We noticed that we were getting a lot of overage charges on our cell data plan, so we switched to unlimited and actually saved money!

- We refinanced our mortgage and rolled in our home equity line, saving hundreds a month in interest payments.

- We cashed in our credit card perks points to get a large sum of money, which we put toward the balance.

- We had an almost ‘no-spend’ Christmas with handmade or previously enjoyed items, and we sold things around our house to fund the remainder.

Then we seriously just hunkered down, sold things around the house we no longer needed, did without, reused and reduced, until we finally paid off our credit card in full. PHEW!!! Not only was that a huge relief, but it also recouped for us those hundreds of dollars that were disappearing to interest payments!

PLANNING AHEAD – NO CREDIT DEBT AGAIN EVER

Now without that credit debt looming over us, we could focus on planning ahead so we would no longer even need our credit card. Remember that category I set up called “Budgeting Ahead” that was filled with big time annual charges? I set goals for each of those categories with end dates, and I started putting aside money each month in preparation for the expense. When the time comes, the money is there, and we don’t have to put anything on our credit card.

We also adhere to our monthly budgeted amounts in variable categories. For example, if we set aside $50 for family dining out, we’ll always check it before we make any decisions. If we don’t have the money to go out, we don’t.

And maybe my favorite part (and a major key ingredient for not accruing interest payments) is that at any given moment, I know exactly how much I can and should pay down on our credit card. Since every dollar has a job, I know that I can pay my credit card balance every single day to avoid accruing interest, and I know exactly how much to pay. At the very top of the webpage or app, the first line item tells me how to wipe out my credit balance based on how I’ve spent money and assigned dollars. Before YNAB, I just had to guess? hope? pray? that I paid the balance and didn’t offset any other needs I’d have for the month. To that end, I check it and pay our credit card at least once a week if not more. This practice alone has saved us hundreds of dollars a month in interest, while allowing us to continue using our credit card to earn incentives.

FINAL WORDS

To me, being able to set goals and budget ahead has been the best part of YNAB. Without that, we’d continually be stuck in this perpetual debt cycle. Between carefully observing our habits, adjusting as needed, and planning ahead, it’s been a real miracle for our family. It also helps us to have clear agreements and communication. Since the app syncs to our phones and laptops and doesn’t live in a spreadsheet on someone’s computer, we have constant access and can make informed, team-based decisions in the moment.

In case you can’t tell, I highly recommend YNAB for getting your budget and life together. I don’t ever want to go back to a life without it!

![]()